Three reforms needed for a balanced economy

Three important measures, including implementation of the financial act, and exchange rate and interest rate reforms, are needed to restore balance to the economy within one or two years although there may be growing pains, a noted economist said yesterday.

Bangladesh has a good financial act and banking law, but implementing those laws to ensure good governance in the banking sector is a major challenge, said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue (CPD).

Another reform that Rahman proposed was to ensure the foreign currency exchange rate is market-oriented. He also recommended a reform in the interest rate.

He suggested that if these three reforms could be implemented, the economy would find a stable footing within one or two years.

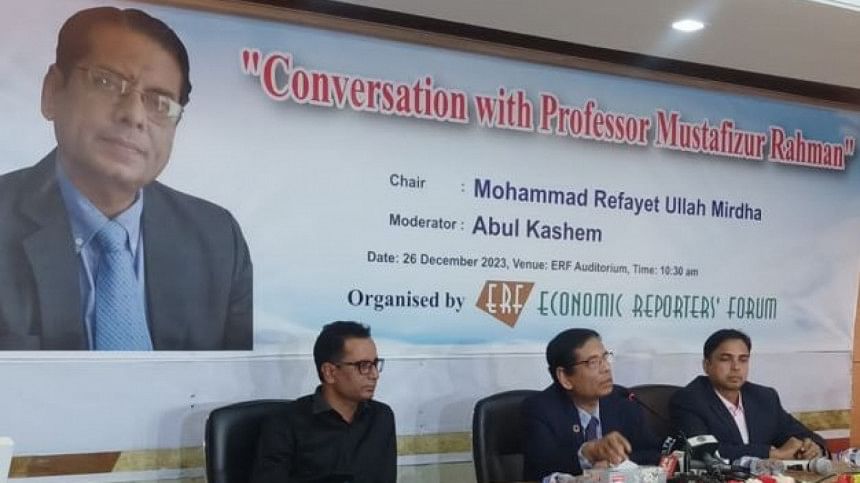

But implementation will be painful, Rahman added during a discussion, titled "Conversation with Mustafizur Rahman", organised by the Economic Reporters' Forum (ERF) at its office in Dhaka yesterday.

Rahman discussed different economic issues during the conversation.

He said the salaries of workers, including garment workers, should be increased to a decent level as the real income of workers did not increase over the years.

For instance, real income in Bangladesh increased by 74 percent since independence up to the year 2006, but the real income of workers increased by only 4 percent.

He also suggested that providing different facilities to workers in factories would act as a kind of incentive since Bangladesh will not be able to give direct subsidies to exporters after graduating from least developed country (LDC) status in 2026.

Politics and the economy are interrelated, he said. Good politics means a good economy and a good economy indicates good politics. For instance, increasing tax collection from the consumers is a political decision which cannot be ignored, he added.

Regarding concerns about a sanction from the US, Rahman said it was difficult to say exactly what the American government would impose on other countries.

Instead, Bangladesh should focus on reforms so that working conditions in the garment sector can be improved and other nations are convinced not to impose any trade restrictions.

He questioned why other countries needed to always put pressure for reforms, saying the country and garment sector should adopt reform themselves so no nation can speak about sanctions.

Bangladesh has three important goods, including garments, pharmaceuticals and leather and leather goods, through which the country can diversify and earn foreign currency.

The global market for garment items is worth more than $700 billion and Bangladesh's share of the pie is nearly eight percent.

This share should be increased to at least 15 percent through diversification within garment items, such as by making more non-cotton items. And it is possible to meet that target as China, which has 31 percent of the global market share, is losing its market share rapidly, he said.

Another important sector is pharmaceuticals, which has a trillion-dollar market globally. Bangladesh needs to complete the active pharmaceuticals ingredient (API) industrial park sooner rather than later to grab a bigger chunk of the global market share.

He also stressed that the government needs to focus more on the leather and leather goods sector so that local entrepreneurs and exporters can gain more of the global market share.

On the banking issue, Rahman said the sector was witnessing a vicious cycle of corruption and money laundering due to lax monitoring by the Bangladesh Bank.

The central bank should have more independence in terms of proper monitoring of other scheduled banks, although reforming the banking sector is not possible overnight, he added.

A CPD report published on Sunday stated that the amount of money embezzled from the banking sector through loan scams since 2008 had reached Tk 92,261 crore. But Rahman added that the sum could be much higher.

He also opined that inflation may reduce to some extent, but warned that consumers would feel the pinch of purchasing goods at higher rates in the coming months.

Replying to a query, the CPD distinguished fellow said there was no possibility of famine in the country in March next year as the production of crops was good.

He added that the risk of a famine would not arise due to lower production of crops, but because of mismanagement in the distribution of crops.

Mohammad Refayet Ullah Mirdha, president of the ERF, chaired the session while Abul Kashem, ERF general secretary, moderated the discussion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments