Agent banking branching out even further

Agent banking, which helps bring banking services to unbanked people, continues to gain ground in Bangladesh as the number of accounts, deposit collection and loan disbursement are on the rise.

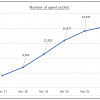

The number of accounts opened through agent banking outlets rose 23 percent year-on-year, or 37.76 lakh, to 1.98 crore in June 2023, according to central bank data.

Of them, 1.71 crore are from rural areas and 26.85 lakh from urban areas. In comparison with June 2019, the number accounts increased by around 481 percent from 1.22 crore.

The overall deposit balance with agent banking stood at Tk 366,258 crore as of June this year, registering an increase of 18 percent year-on-year, Bangladesh Bank data shows.

The number of accounts opened through agent banking outlets rose 23 percent year-on-year, or 37.76 lakh, to 1.98 crore in June 2023, according to central bank data

Loan disbursement through the agent banking channel was Tk 854 crore that month, up 27 percent year-on-year.

Besides, migrant workers used the service to send home Tk 3,029 crore in June, up 33 percent from Tk 2,272 crore during the same month in 2022.

Similarly, the number of transactions rose 10 percent to about 2.13 crore in June compared to the same month the year before and transaction volume swelled by 24 percent to Tk 72,693 crore.

Meanwhile, the number of agents jumped 8 percent year-on-year to 15,510 while the total number of outlets reached 21,861 by the end of June, up 8 percent compared to the same month a year ago.

The number of accounts held by men advanced 22 percent to about 97 lakh and the number of accounts owned by women went up by a staggering 25 percent to around 98 lakh at the same time.

"Agent banking is a good model as people are using it with ease," said Md Arfan Ali, former managing director of Bank Asia, which pioneered the new banking model in the country in January 2014.

There are two major reasons -- lack of formalities and rural entrepreneurship -- for intensifying agent banking in the rural areas, where access to personal banking services is helping women become entrepreneurs, he added.

Ali went on to say that agent banking will be sustained in the future despite the growth of digital banking.

"But when someone wants to conduct cash-in or cash out transactions, they have to go to physical outlets," he said.

"Bangladesh may need some time to for full automation. So, agent banking will survive easily," he added.

He also said that when Bank Asia rolled out their agent banking service, two things were kept in mind: promoting entrepreneurship and taking banking services to the people's doorsteps.

The owners of outlets are also driven to render good service because their success would also depend on attracting customers and retaining them, Ali said.

The central bank introduced agent banking to provide a safe alternative delivery channel for banking services to the underprivileged, under-served population, who generally live in remote areas beyond the reach of the traditional banking network.

Bangladesh Bank has so far issued licences to 31 banks for operating agent banking activities, all of which are in operation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments